richmond property tax rate

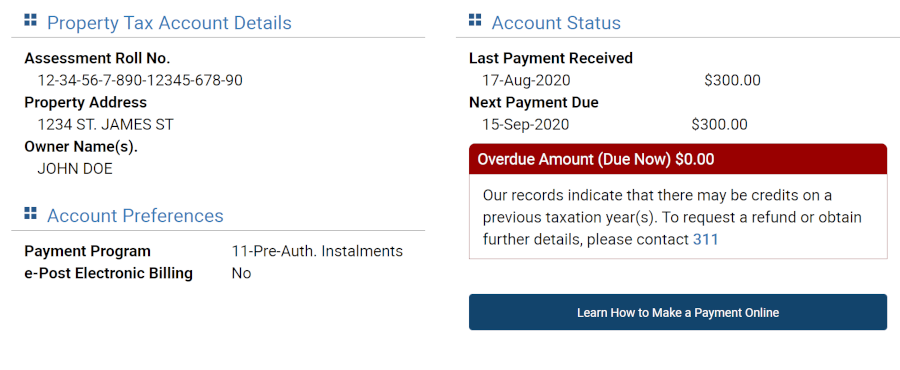

Manage Your Tax Account. Im thinking of moving to Richmond and need some help figuring out some property tax estimates.

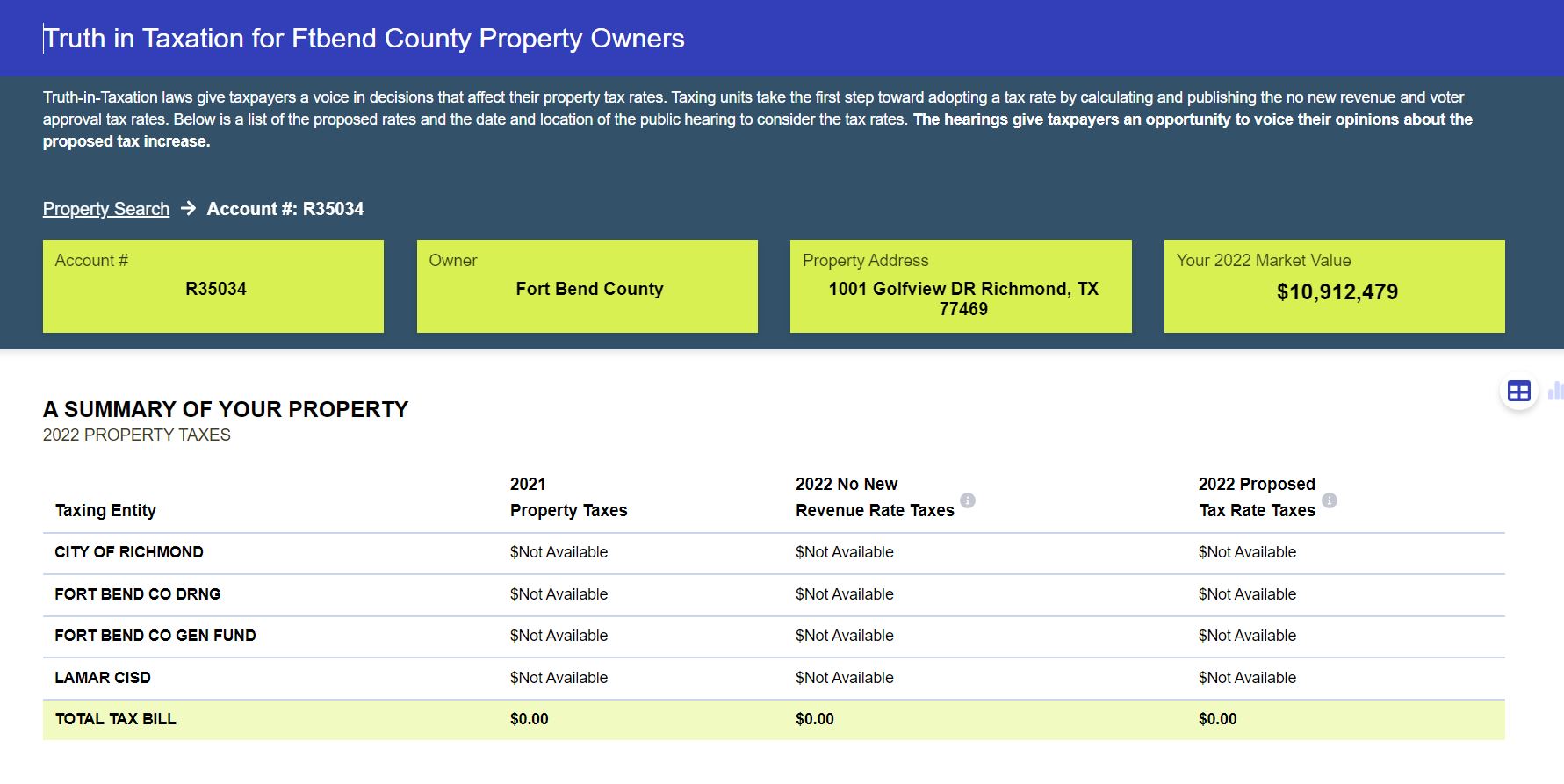

Property Taxes In Texas This Is How To Check How Much You Re Paying Where Your Money Is Going Your Proposed Rate

Any returns filed after May 1 st are assessed a late filing fee of ten dollars 10 or ten percent 10 of the tax assessed whichever is greater.

. Angel Hatfield City Treasurer. Invoice Cloud is a convenient payment option for paying real estate taxes and motor vehicle personal property taxes include creditdebit cards e-checks scheduled payments and. City of Richmond BC - Tax Rates Home City Hall Finance Taxes Budgets Property Taxes Tax Rates Property Taxes Tax Rates These documents are provided in.

30 2021 will receive a 1 discount on the tax portion of their bill a perk that is shared by only a few. Richmond County collects on average 045 of a propertys. Assessment Methodology Individual.

Paying Your Property Taxes. Property Tax Vehicle Real Estate Tax. What is the due date of real estate taxes in the City of Richmond.

The median property tax in Richmond County New York is 2842 per year for a home worth the median value of 461700. Building Department. Taxpayers can either pay.

What is the real estate tax rate for 2021. Real estate taxes are due on January 14th and June 14th each year. Real estate taxes are due on January 14th and June 14th each year.

For information and inquiries regarding amounts levied by other taxing authorities please contact. Personal property tax bills have been mailed are available online and currently are due June 5 2022. Other Services Adopt a pet.

Property Tax Taxpayers who pay within the first 20 days on or by Sept. PAY YOUR PERSONAL PROPERTY TAXES ONLINE OR BY MAIL. These agencies provide their required tax rates and the City collects the taxes on their behalf.

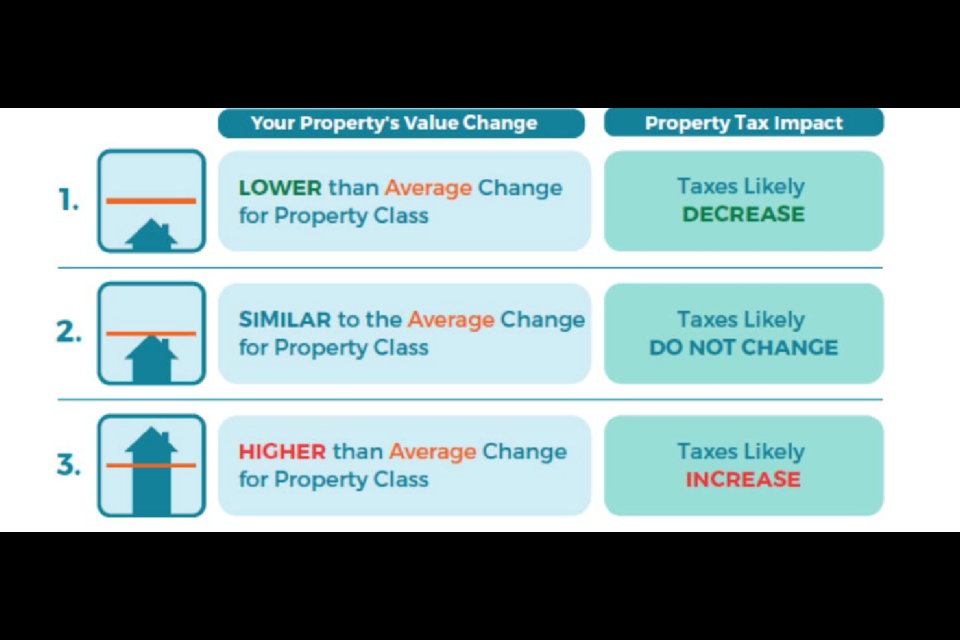

Best 5-Year Variable Mortgage Rates in Canada Butler. Due Dates and Penalties for Property Tax. Richmond Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Possibly you dont know that a real estate tax levy.

What is the real estate tax rate for 2021. Question on RVA property taxes. The median property tax in Richmond County Virginia is 673 per year for a home worth the median value of 148700.

To view the Total Homestead Tax Rates for Cities Villages in Macomb County please click here. Richmond County collects on average 062 of a propertys. Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp.

We have done our best to provide links to information regarding the County and the many services it provides to its. Macomb County Homestead Tax Rate Comparisons. Understanding Your Tax Bill.

What is the due date of real estate taxes in the City of Richmond. Richmond Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Perhaps you arent focused on your tax levy. Welcome to the official Richmond County VA Local Government Website.

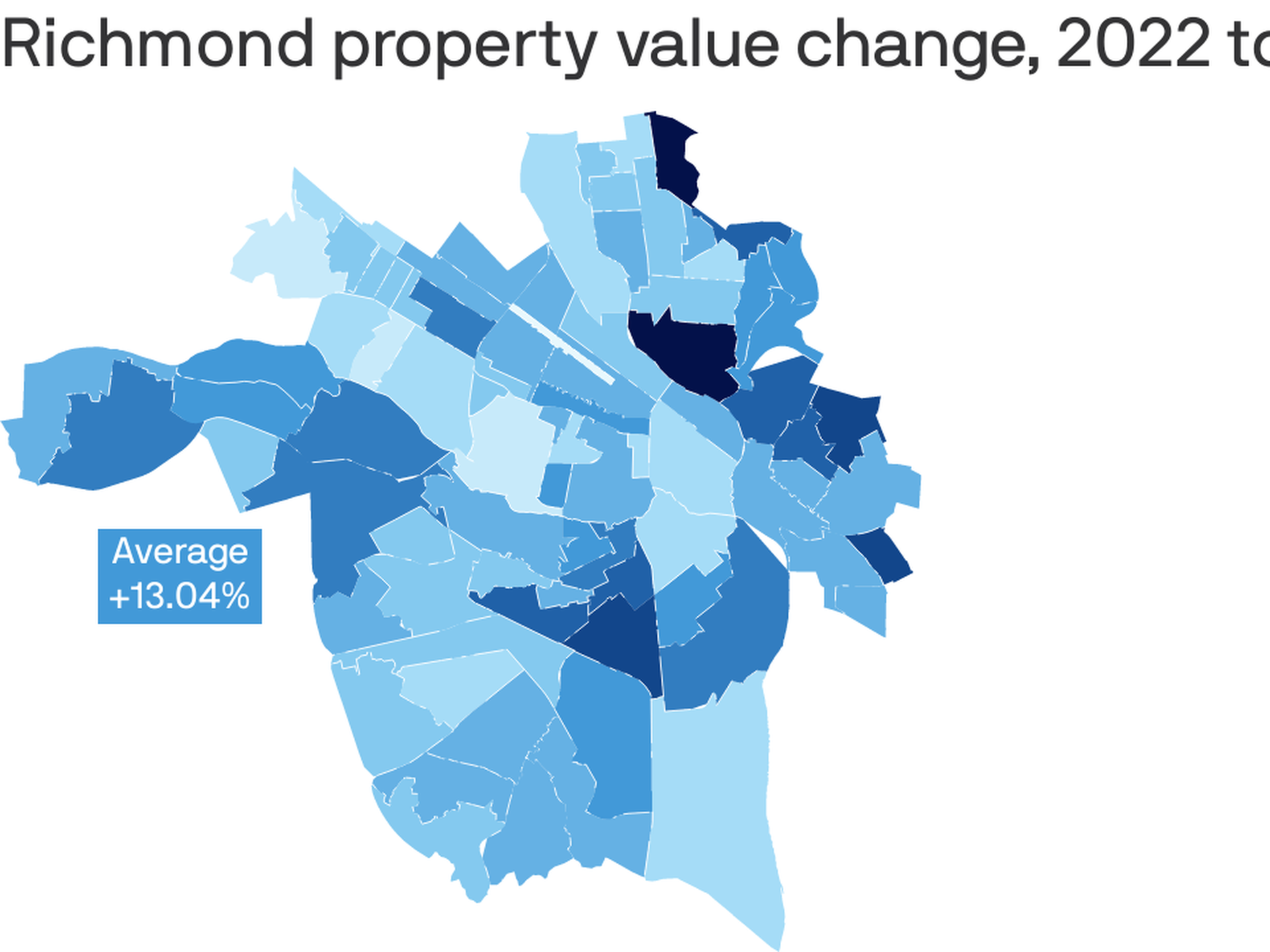

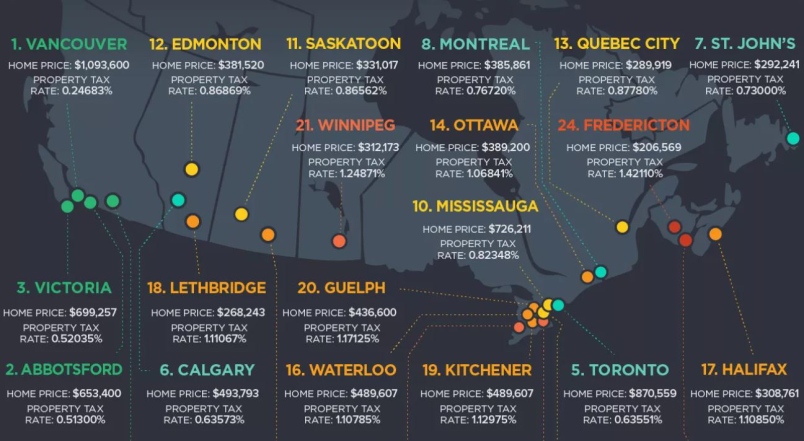

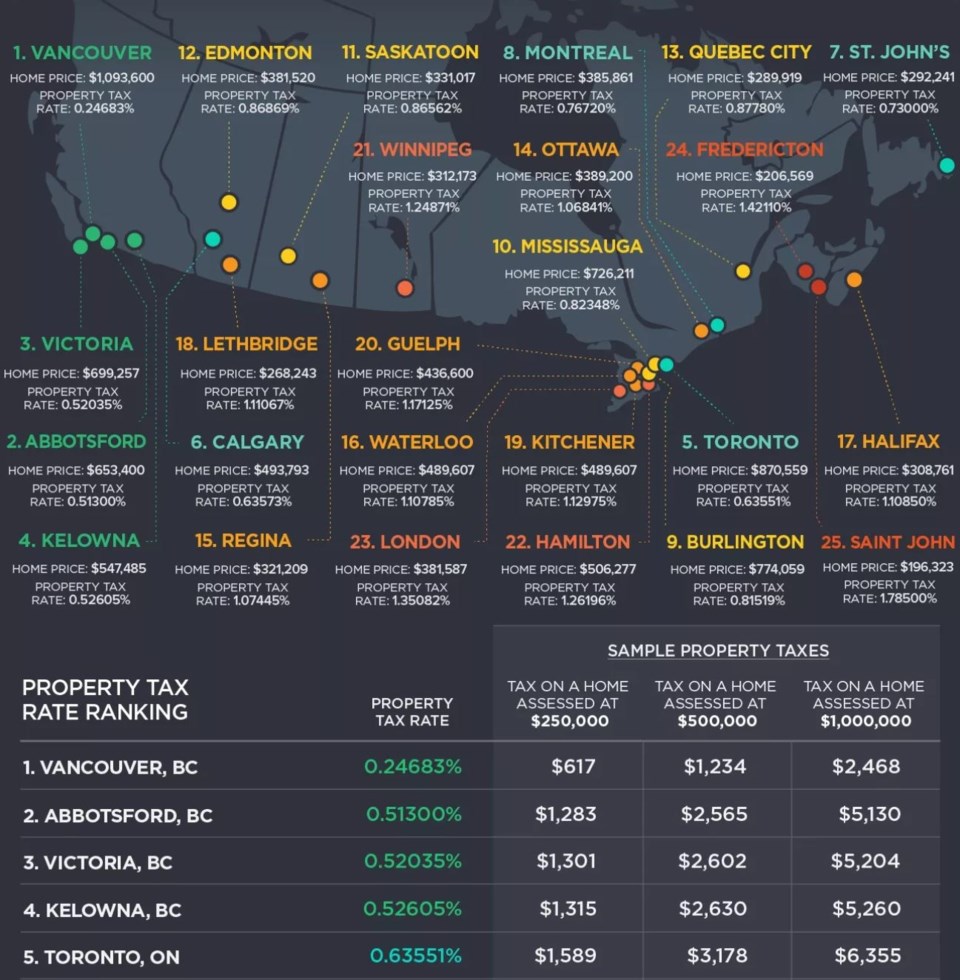

I see that Richmond has a property tax rate of 12 per 100. Richmond property tax rates are the fourth lowest property tax rates in BC for municipalities with a population greater than 10K.

Toronto Property Taxes Explained Canadian Real Estate Wealth

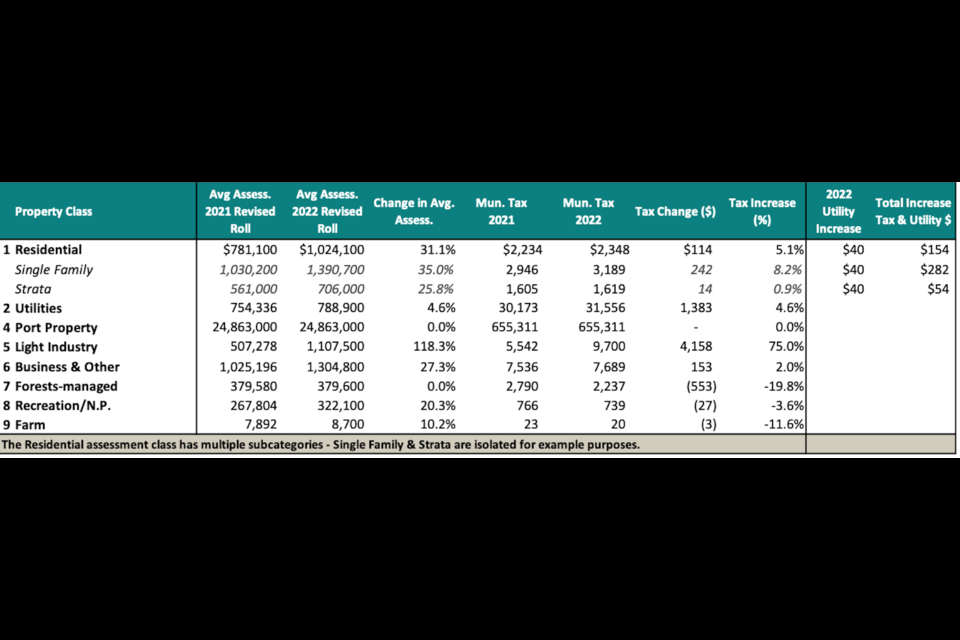

How Much Are Squamish Property Taxes In 2022 Squamish Chief

About Your Tax Bill City Of Richmond Hill

B C Cities Have Canada S Lowest Property Tax Rates Infographic Western Investor

About Your Tax Bill City Of Richmond Hill

Toronto Property Tax 2021 Calculator Rates Wowa Ca

How Much Are Squamish Property Taxes In 2022 Squamish Chief

B C Cities Have Canada S Lowest Property Tax Rates Infographic Western Investor

Where Can I Find My Account Number And Access Code Myrichmond Help

Richmond Property Tax 2021 Calculator Rates Wowa Ca

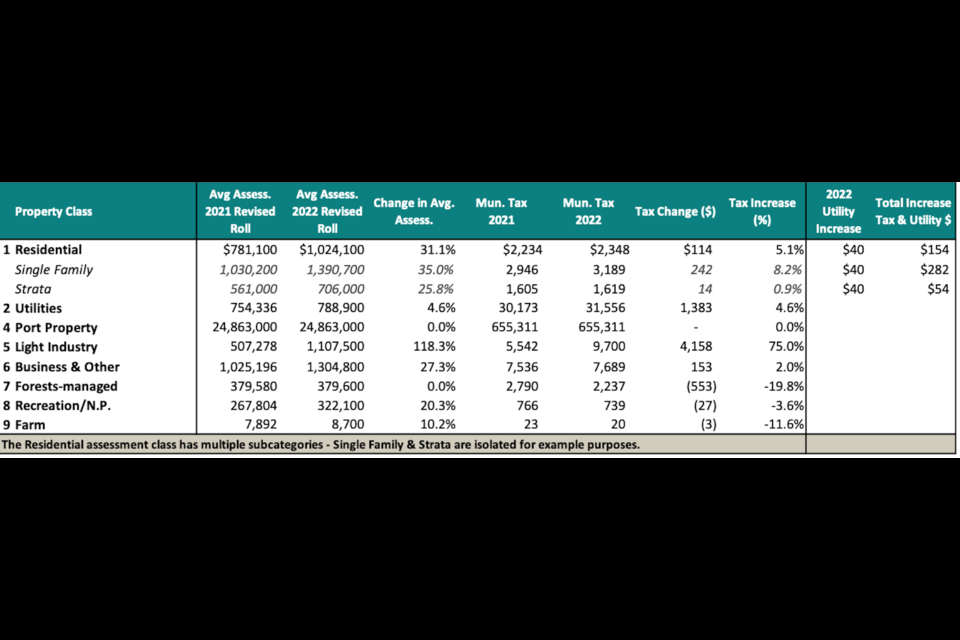

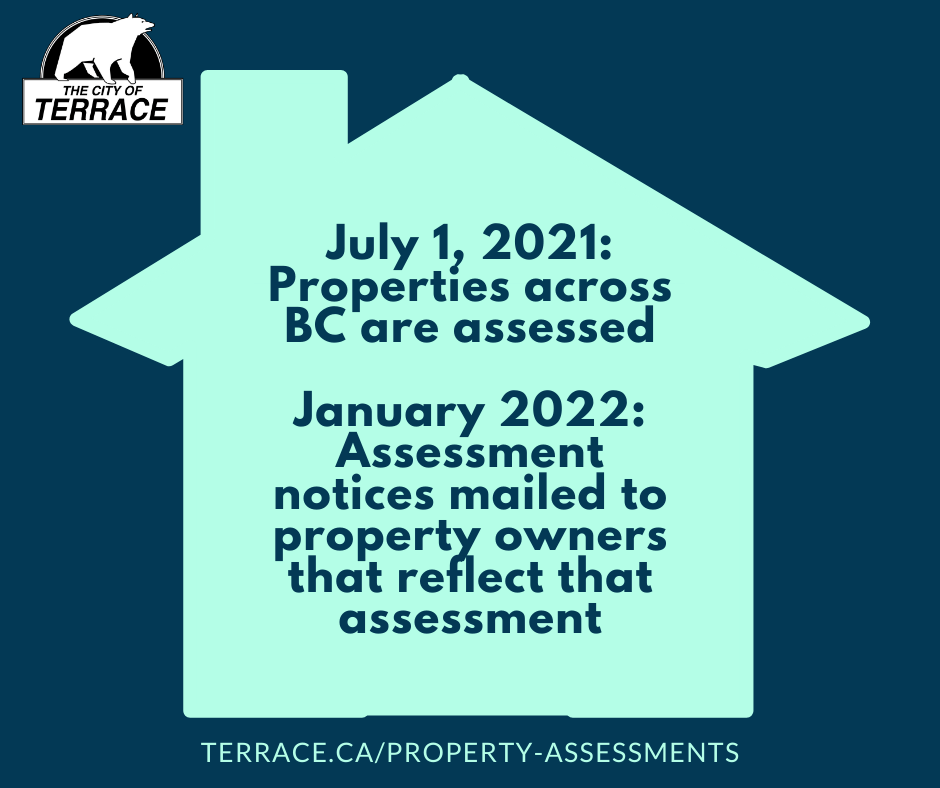

Property Assessments City Of Terrace

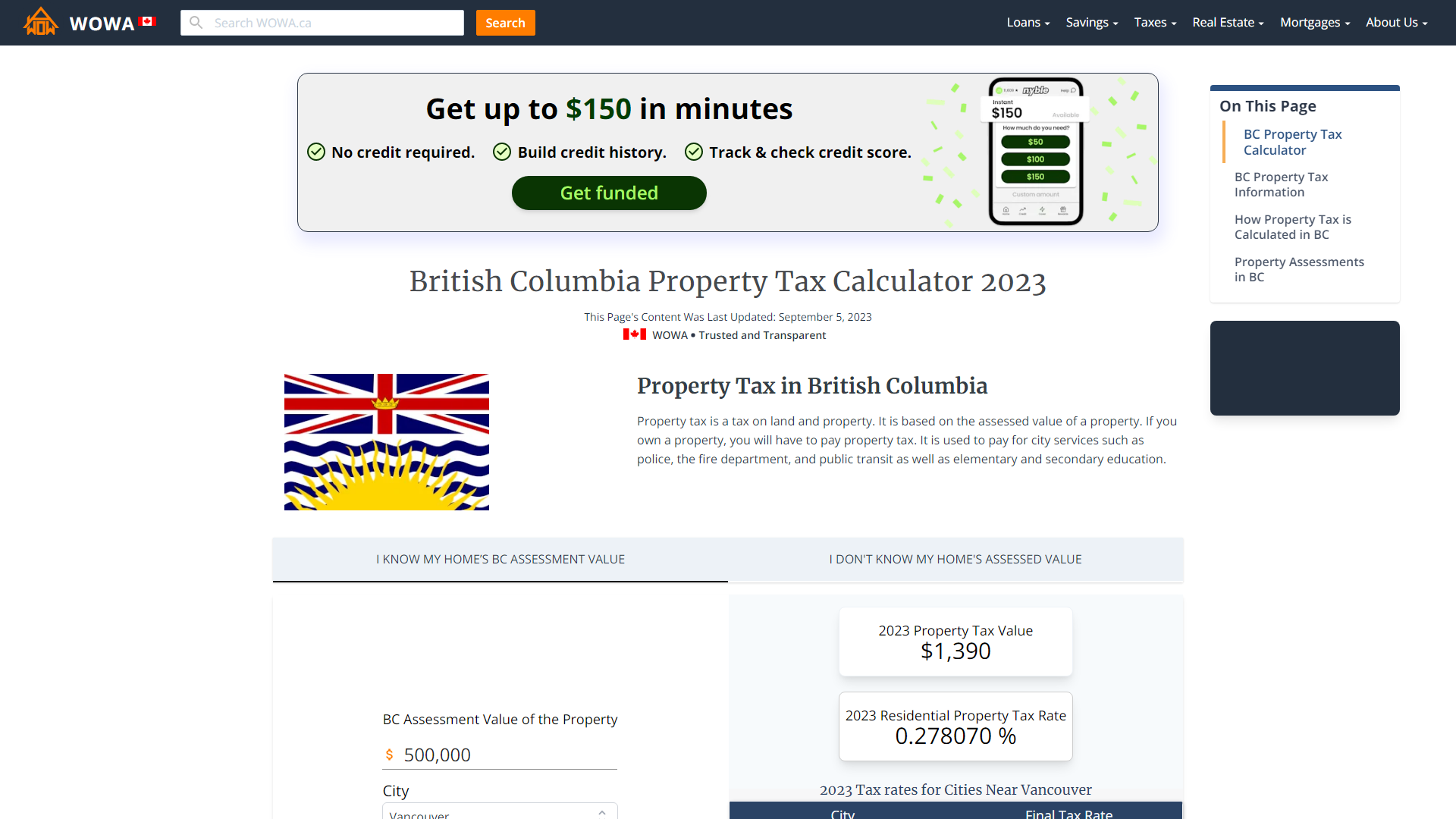

British Columbia Property Tax Rates Calculator Wowa Ca

Here S How Mississauga S Property Taxes Compare To Other Ontario Cities Insauga

Mississauga Boasts 11th Lowest Property Tax Rate In Ontario Insauga

About Your Tax Bill City Of Richmond Hill

Toronto Property Taxes Explained Canadian Real Estate Wealth

These 6 Ontario Cities Currently Have The Lowest Property Tax Rates In The Province Ontario City The Province Ontario